What do I need to know about National Insurance Contributions?

When you make that leap to hire your first employee there’s a lot of legislation to digest which can be confusing. It’s important as an employer that you know what rules apply to you and what rates are applicable for your employees. You will be liable to pay National Insurance Contributions (NIC) for every person you employ. You will need to make payments to HMRC on behalf of the employee and as the employer. Here’s a summary of all the rates for National Insurance which you need to be aware of;

Class 1: National Insurance Thresholds

There are various thresholds and limits which you need to be aware of to make sure that you are contributing the correct amount.

Lower Earnings Limit - £120 per week | £520 per month | £6,240 per year

Primary Threshold - £184 per week | £797 per month | £9,568 per year

Secondary Threshold - £170 per week | £737 per month | £8,840 per year

Upper Secondary Threshold (under 21’s), Apprentice Upper Secondary Threshold (Under 25’s) and Upper Earnings Limit - £967 per week | £4,189 per month | £50,270 per year

Category Letters - What do they mean?

When you process your payroll you will need to ensure each employee is given the right category letter. The category letter determines how much National Insurance both the employee and the employer need to pay.

The majority of employees will fall under category A.

Category A

- All employees unless they fall into any other category

Category B - Married Women/Widows who are entitled to a reduced rate of NIC’s

Category C

- Employees over the age of State Pension

Category J

- Employees who are entitled to defer their National Insurance as they have another job where they already pay their contributions

Category H

- Apprentices under the age of 25

Category M

- Employees under the age of 21

Category Z

- Employees under 21 who have another job where they already contribute to their National Insurance

Category X - Employees who are not required to pay NIC, ie under the age of 16

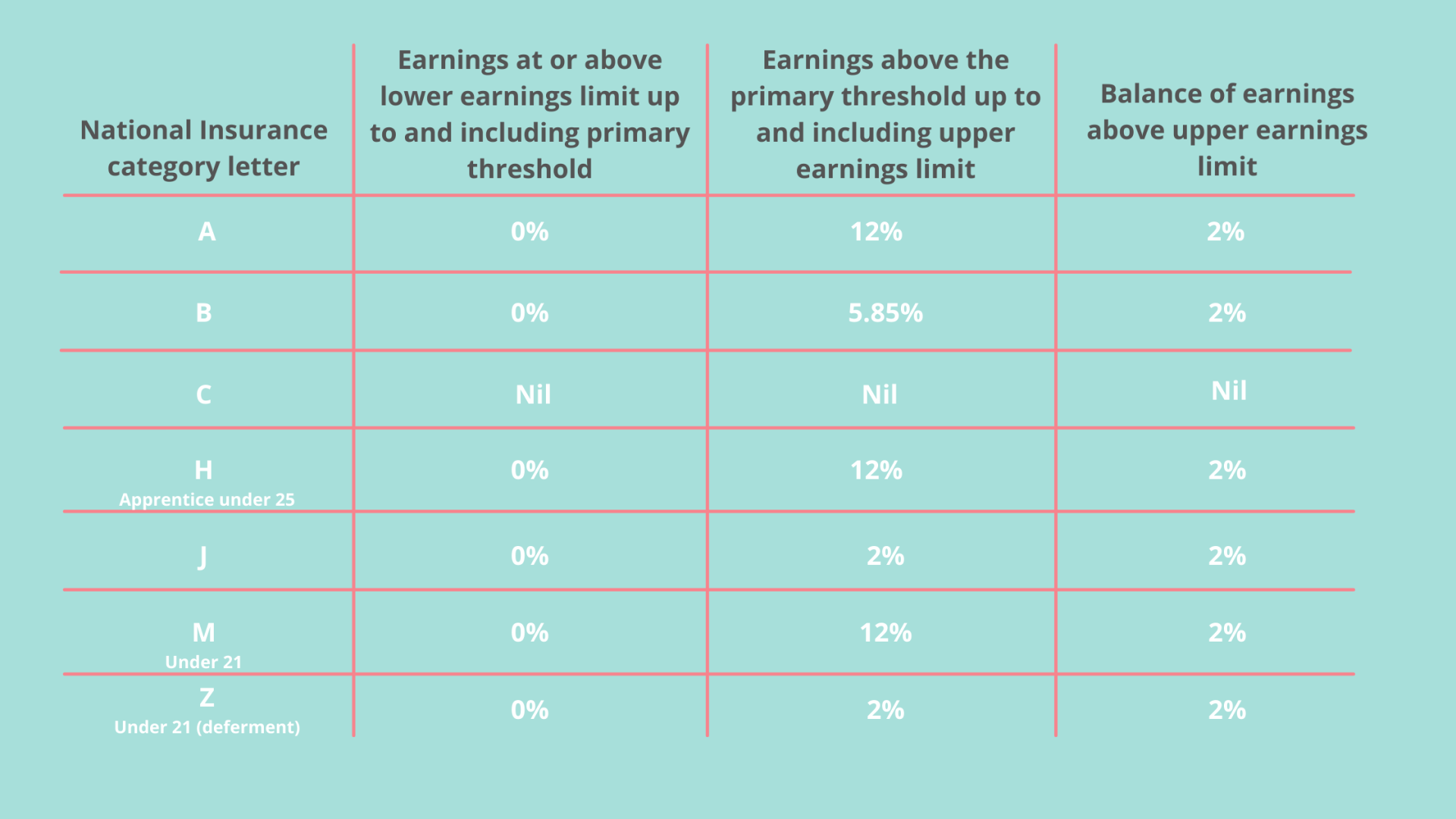

Employee National Insurance Rates

The below indicates how much an employer needs to deduct from an employee's wages for the tax year 2021/2022;

Example

If an employee falls under category A and they earn £1,000 in per week they will pay:

- nothing on the first £184

- 12% (£93.96) on their earnings between £184.01 and £967

- 2% (£0.66) on the remaining earnings above £967

This means their National Insurance payment will be £94.62 for the week.

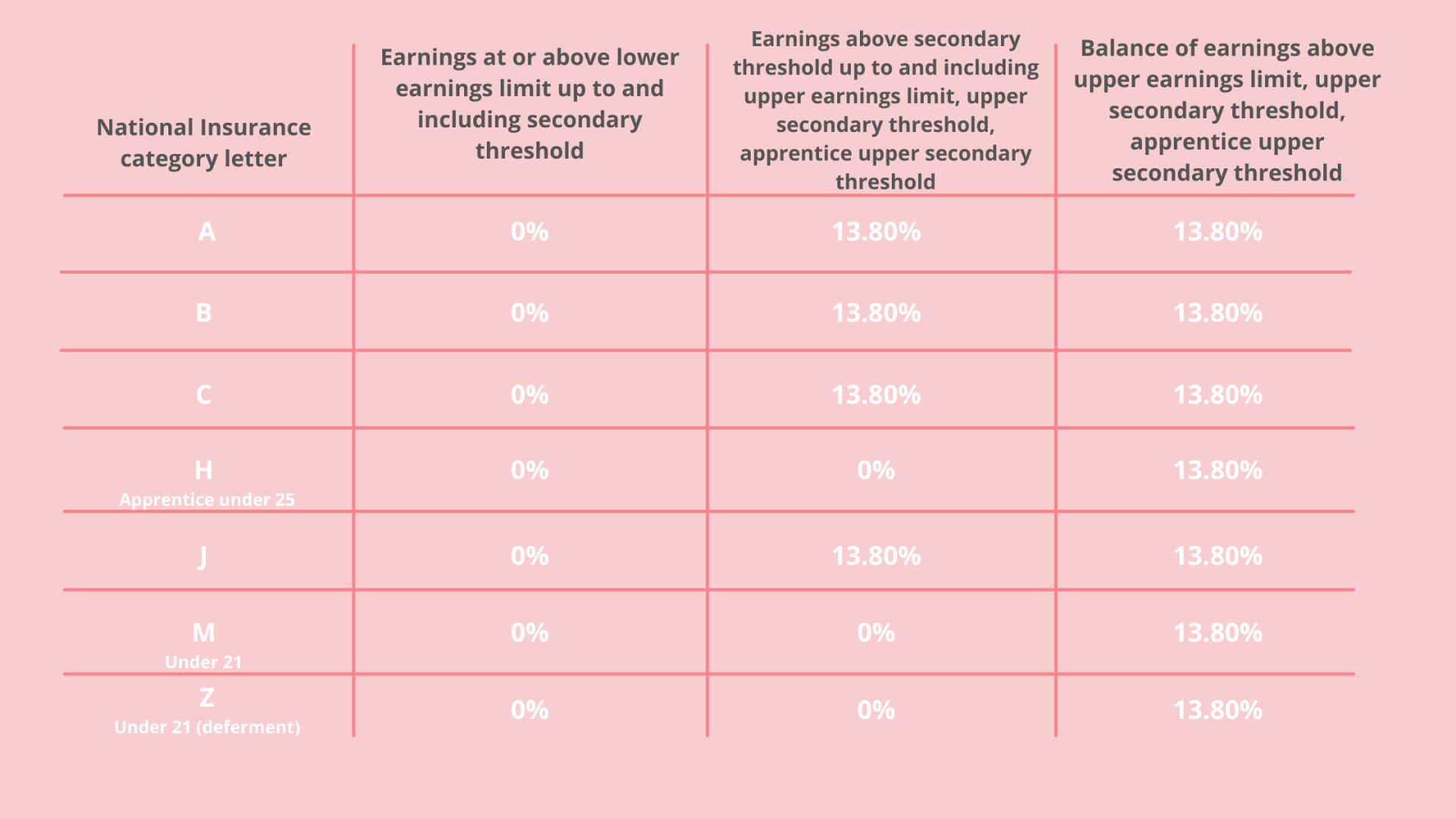

Employer National Insurance Rates

We will now look at how much, you as an employer will need to contribute (2021/2022);

Class 1A and Class 1B rates

If you pay your employees expenses or other benefits then you will need to pay Class 1A and 1B National insurance.

If you’re still confused about what contributions you need to pay then you can use HMRC’s online

calculator. Or better still leave your Payroll to Bluebells Bookkeeping Limited!